2023 paycheck calculator

It will be updated with 2023 tax year data as soon the data is available from the IRS. Free salary hourly and more paycheck calculators.

Pay Parity Calculating Your Pay Ece Voice

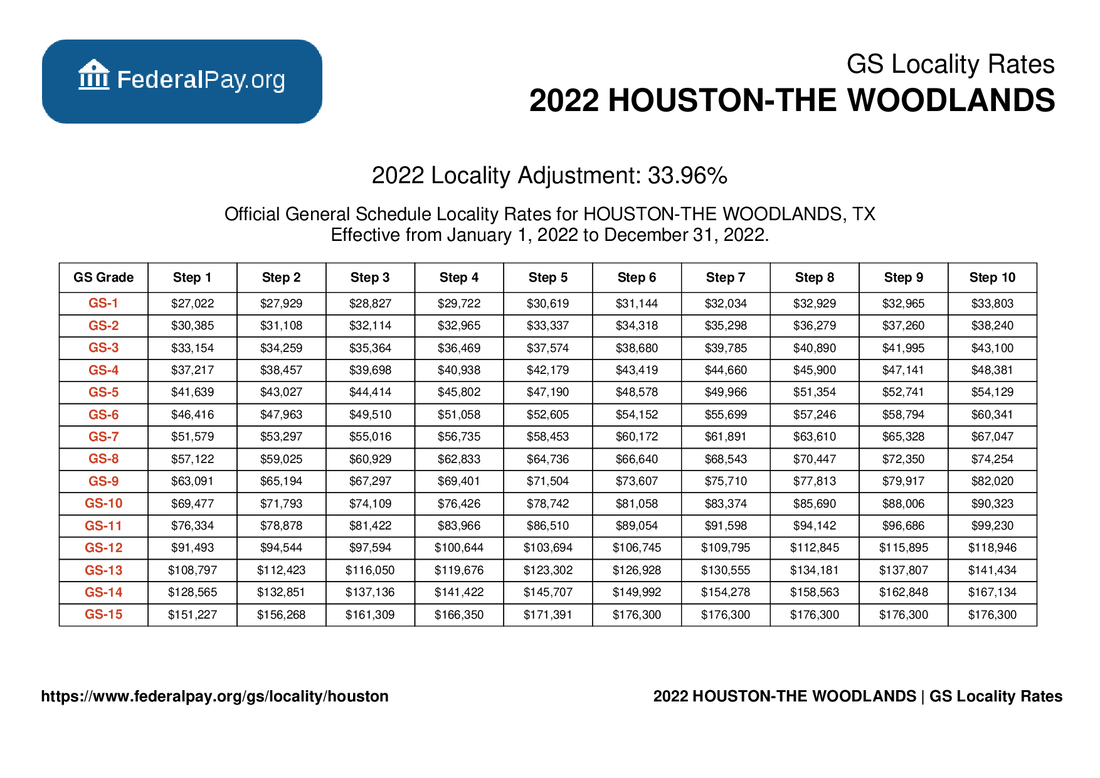

The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board raise.

. Work out your adjusted gross income. Figure out your filing status. Subtract 12900 for Married otherwise.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The 2023 Calculator on this page is currently based on the latest IRS data. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

As the IRS releases 2023 tax guidance we will update this tool. It can also be used to help fill steps 3 and 4 of a W-4 form. Try out the take-home calculator choose the 202223 tax year and see how it affects.

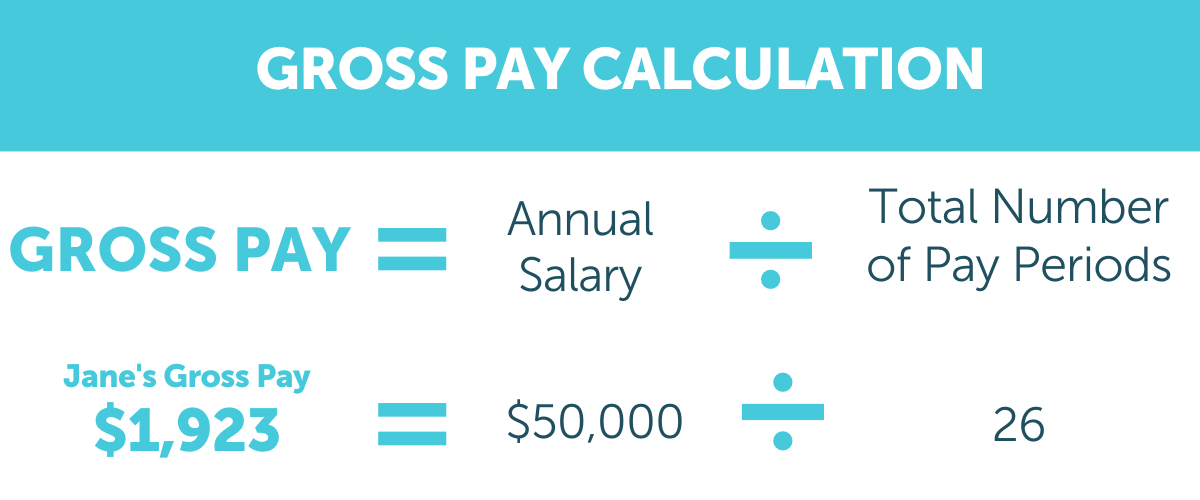

In Iowa the rates for 2022 are between 0 and 75 of the first 34800 of taxable wages depending on the number of employees you have. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator.

Prepare and e-File your. Employers can enter an. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Iowa also requires you to pay. Louisiana paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. The salary calculator will compare the cost of living in each city and display the amount that you would need to earn.

For example if the cost of living is higher in your new city then you would. This Tax Return and Refund Estimator is currently based on 2022 tax tables. See where that hard-earned money goes - with UK income tax National Insurance student.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The official 2023 GS payscale will be published here as. FY 2023 Per Diem Rates apply from October 2022 - September 2023.

Social Security retirees are expected to see the largest increase to their 2023 benefits in decades. IRS Federal Taxes Withheld Through Your. Salt Lake City has a fixed per-diem rate set by the General Services Administration GSA which is.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. 2022 Federal income tax withholding calculation.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Ts Prc Calculator 2023 For Teachers Employee Salary With New Fitment

2023 Va Disability Pay Dates The Insider S Guide Va Claims Insider

Houston Pay Locality General Schedule Pay Areas

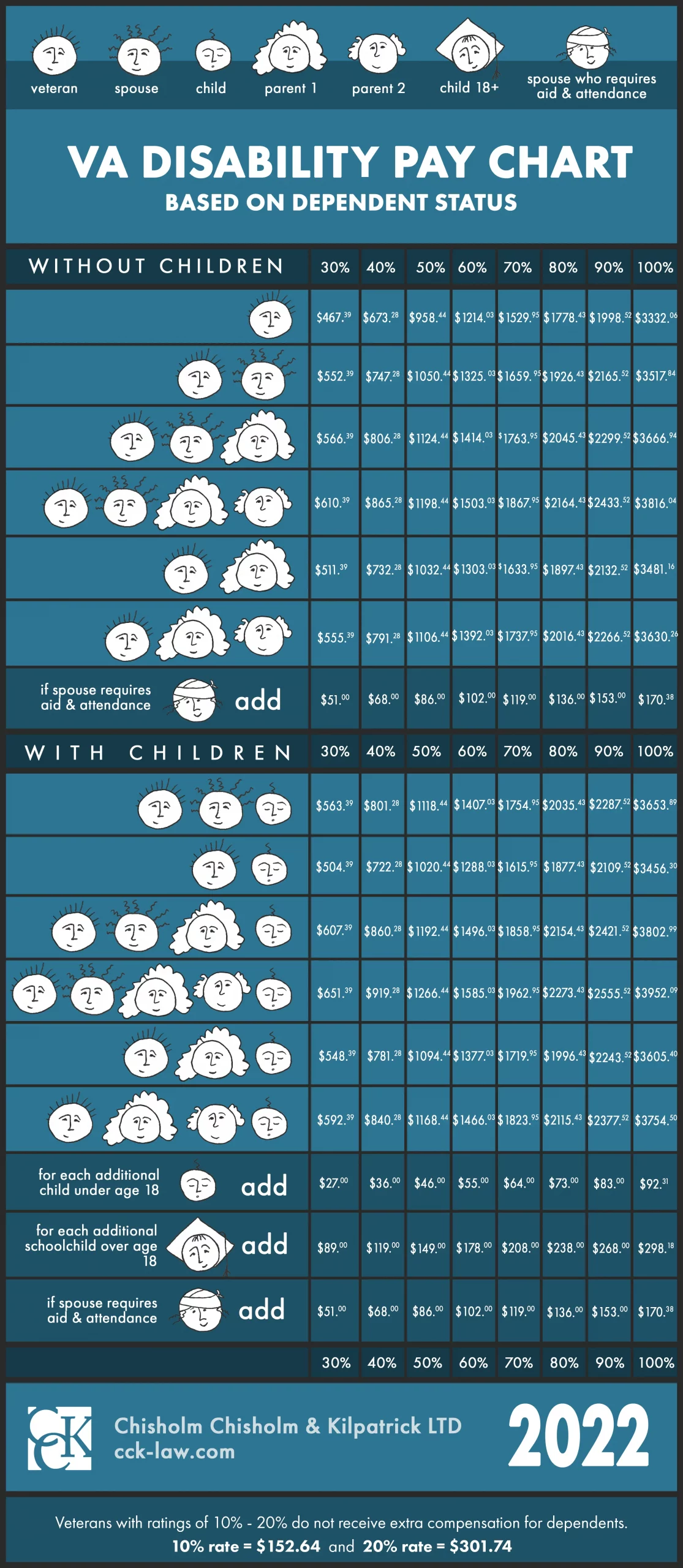

Projected 2023 Va Disability Pay Rates Cck Law

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

8kvx6u8n0uuzym

Projected 2023 Va Disability Pay Rates Cck Law

2

Payroll Calendar Los Angeles City Controller Ron Galperin

Ptu Pay Schedule

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

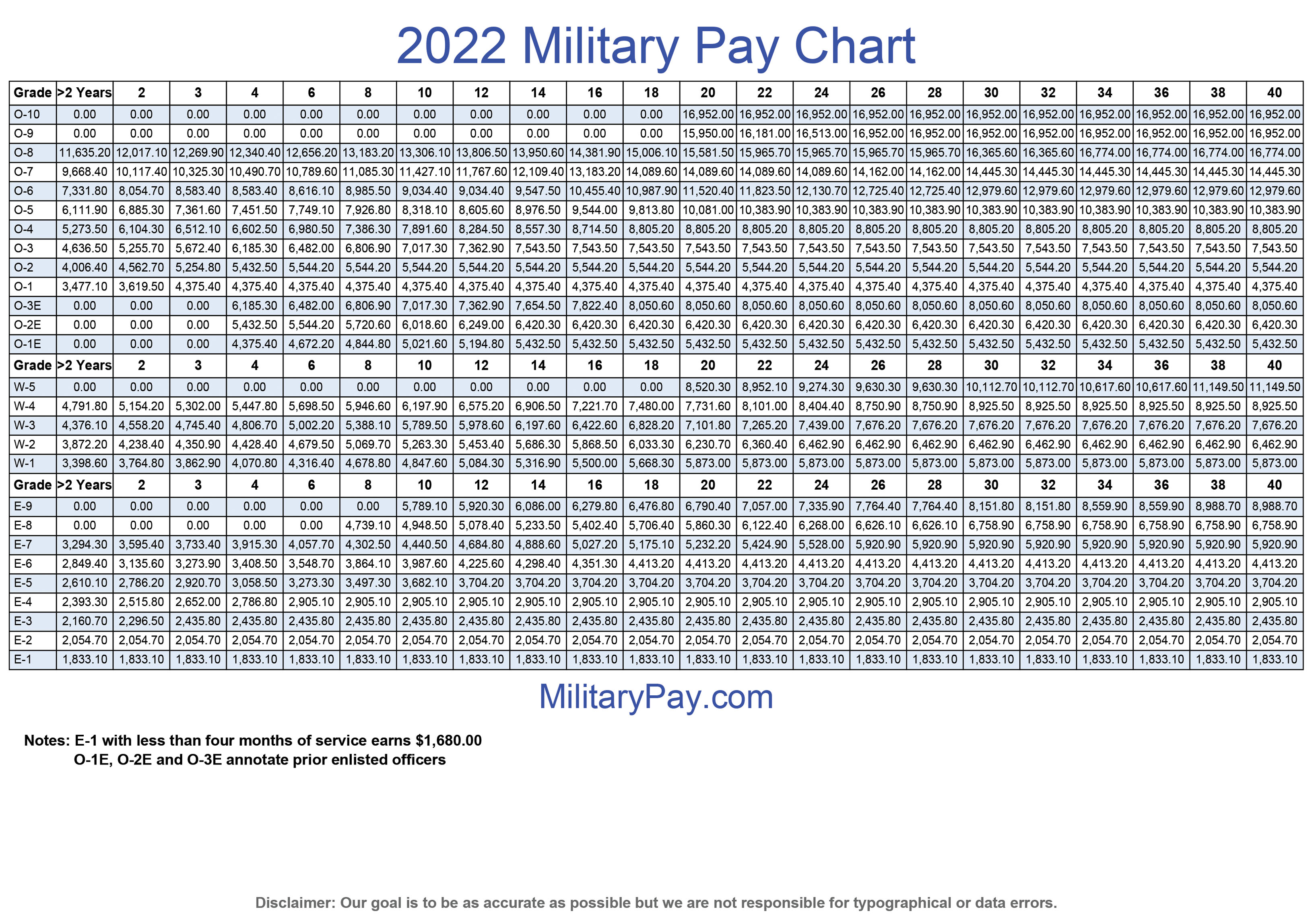

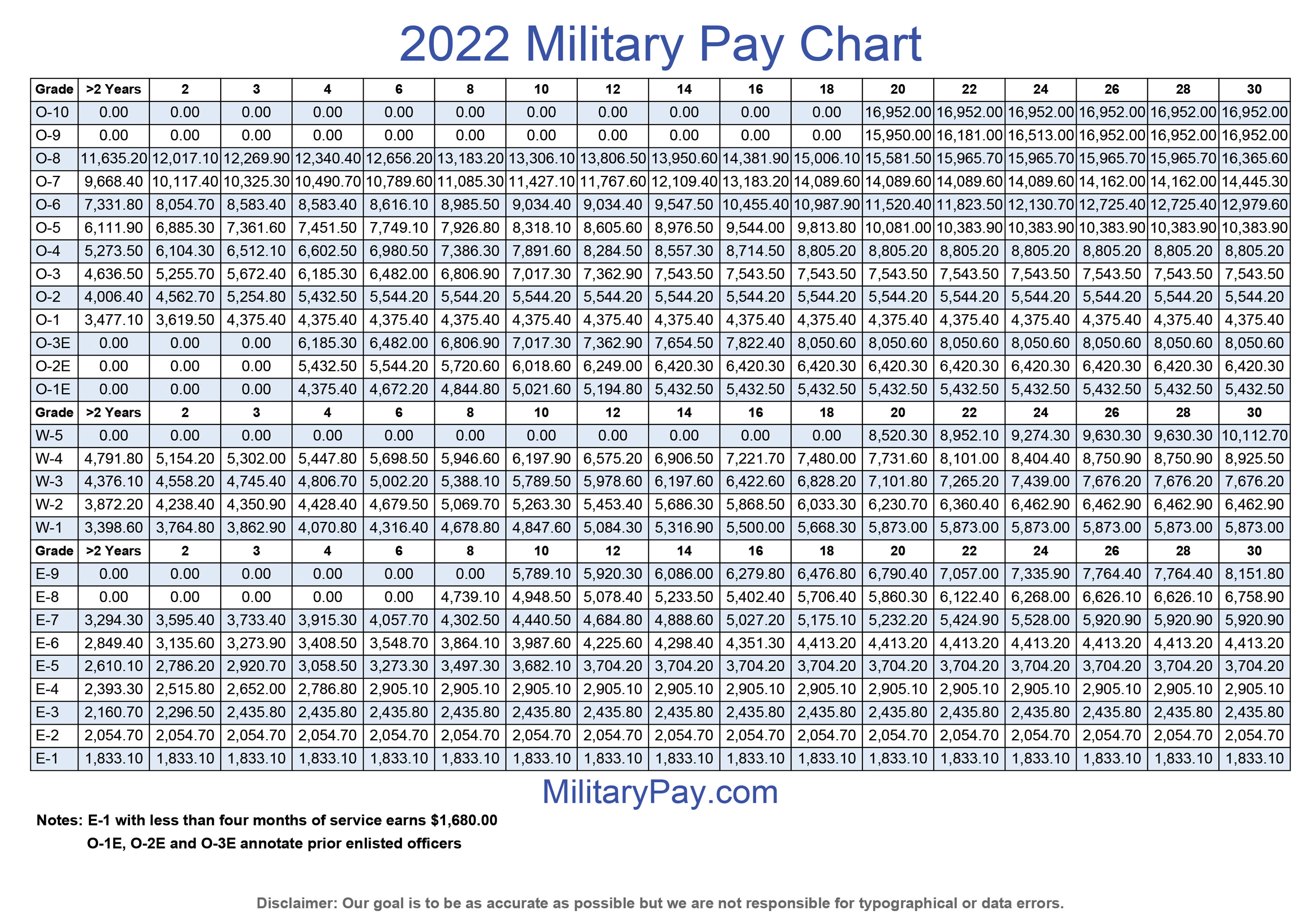

Military Pay Charts 1949 To 2023 Plus Estimated To 2050