36+ Ca Payroll Calculator

This number is the gross pay per pay period. Web Use ADPs California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Payroll Calculators California Payroll

Simply enter their federal and state W.

. Next divide this number from the annual salary. Backed by experts so you dont have to be one. Web Earnings Withholding Calculator.

Web The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Step 2 - Gross Earnings.

Get the top-rated payroll HR software. Web To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Step 1 - Pay Period.

Web The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Just enter the wages tax withholdings and other. Paycheck Calculator Download.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Examples of payment frequencies include biweekly semi-monthly. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California.

It will confirm the deductions you. Web Our paycheck calculator estimates employees California take-home pay based on their taxes and withholdings. Compare Find Payroll Services for Businesses Of Any Size.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Find Your Perfect Payroll Partner Today.

Ad Top-ranked payroll HR software that keeps your business running smoothly. Web First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. How often is the employee paid.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Tax year Job type. Web California Salary Paycheck Calculator Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

Ad Say Goodbye to Payroll Stress Errors. Web The state income tax rate in California is progressive and ranges from 1 to 123 while federal income tax rates range from 10 to 37 depending on your income. Web You can use our California payroll calculator to figure out your employees federal withholding as well as any additional taxes you are responsible for paying as the.

Web California Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck. It automatically calculates key information based on the state. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

If you have questions about Americans with. Web California Paycheck Calculator Calculate your take-home pay after federal California taxes Updated for 2023 tax year on Sep 19 2023 What was updated. Web Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

You can add multiple rates. Use our paycheck tax. Employees Gross Earnings.

This calculator will take a gross pay and calculate the net. Paycheck Calculator California State Controllers Office. Web The calculators allow employees to calculate paychecks for monthly semi-monthly and bi-weekly in one place which also can be used for out-of-state employees with no state.

Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Use the Free Paycheck Calculators for any gross-to-net calculation need. Web California Hourly Paycheck Calculator.

Paycheck Calculator Take Home Pay Calculator

Pdf The Impact Of Female Labour Force Participation On Household Income Inequality In Switzerland

Franklin 12 Language Translator Amazon Ca Office Products

California Paycheck Calculator Smartasset

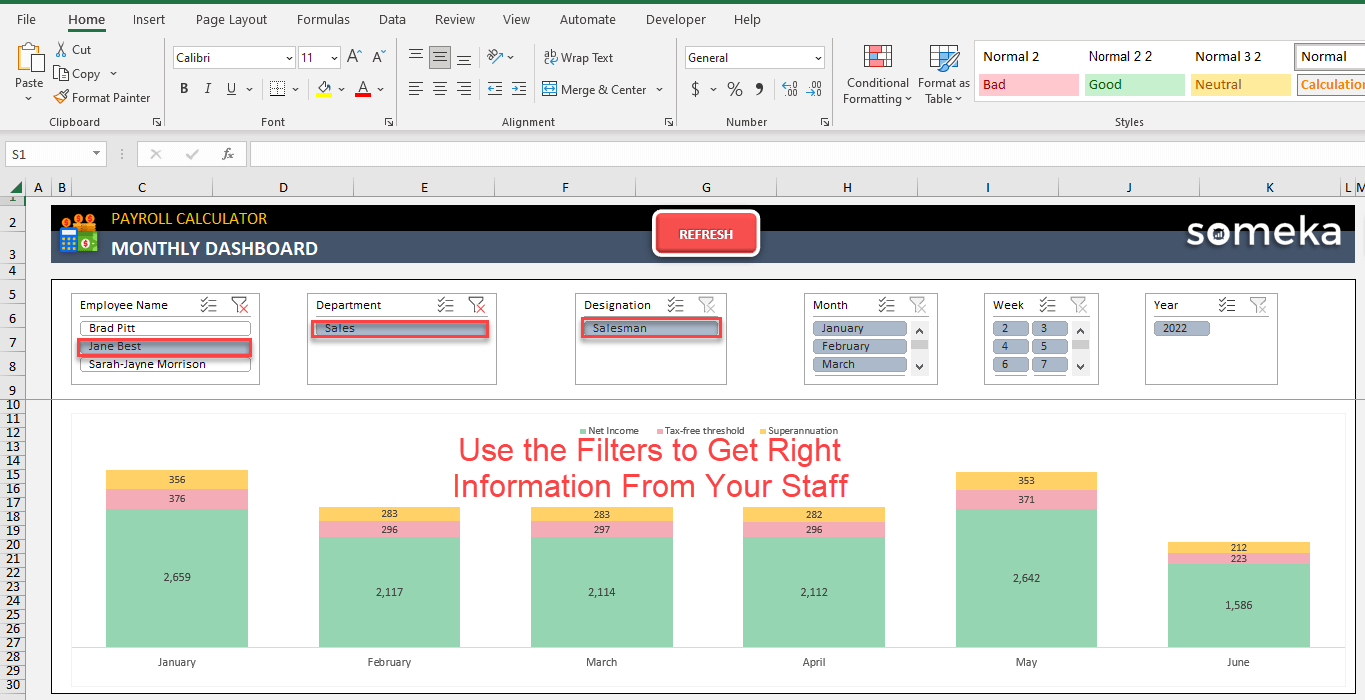

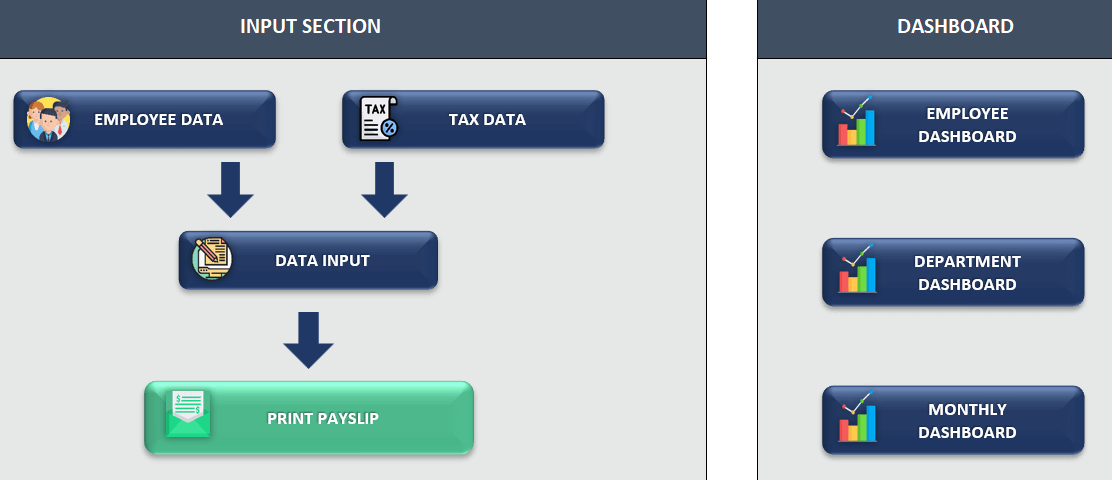

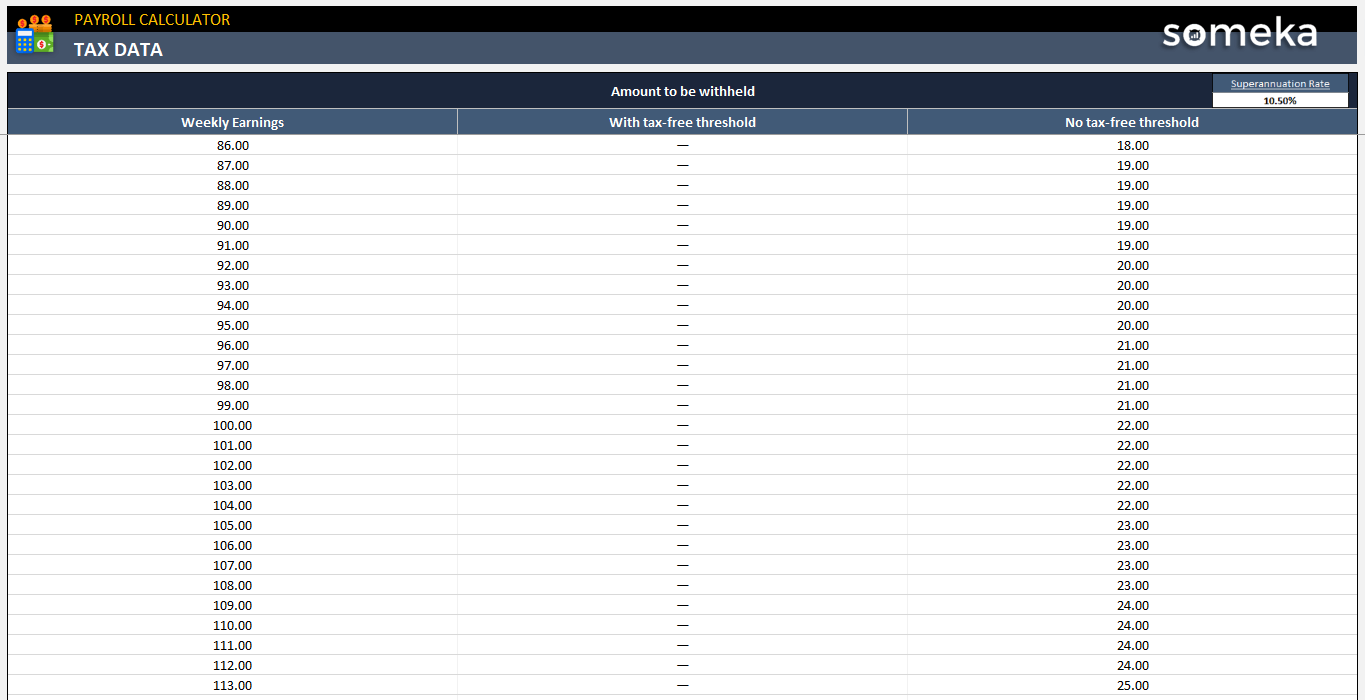

Payroll Calculator Excel Template 2023 Paycheck Spreadsheet

Payroll Calculator Free Employee Payroll Template For Excel

Salary Slip Explained Insideiim

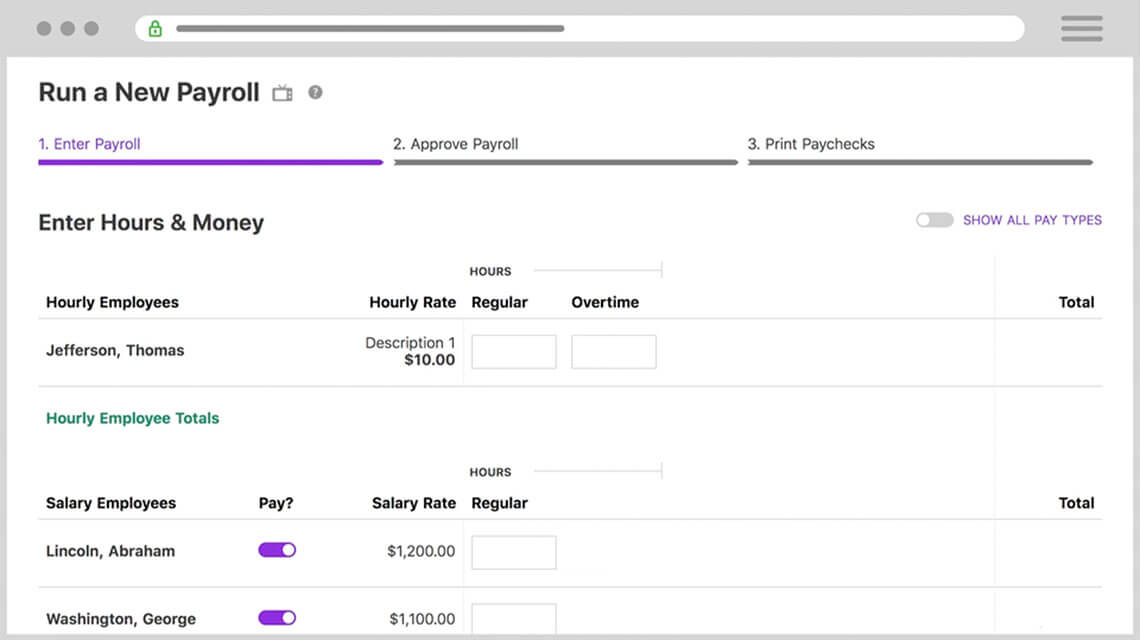

Online Payroll For Small Business Patriot Software

Whisperclaims R D Tax Credit Software Wolters Kluwer

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Calculator Excel Template 2023 Paycheck Spreadsheet

G94171moi003 Gif

How To Build An Excel Model For Income Tax Brackets Quora

Payroll Calculator With Pay Stubs Hr Insider

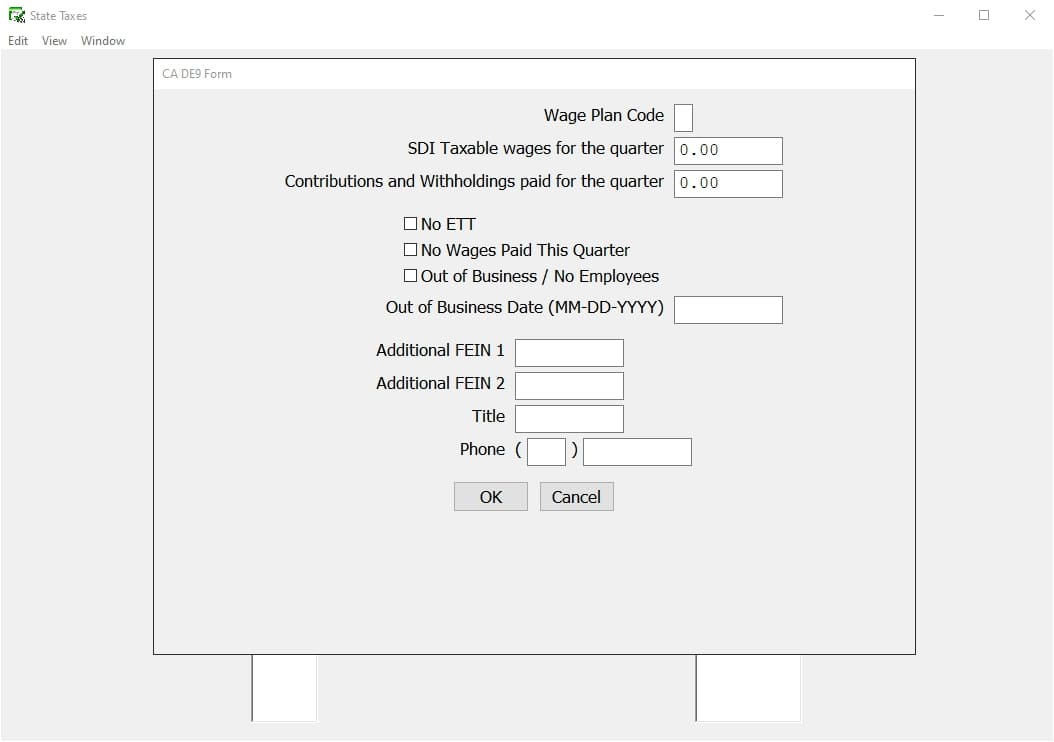

Payroll Calculators California Payroll

Payroll Calculator Excel Template 2023 Paycheck Spreadsheet

Journal Of Personnel Psychology Issue 1 2019 By Hogrefe Issuu